Many expats come to Beijing to make money and save. But we wondered what does everyone do with what they earn? We talked to four disparate Beijing families, who shared with us a usually private part of their lives: finance and disposable income management.

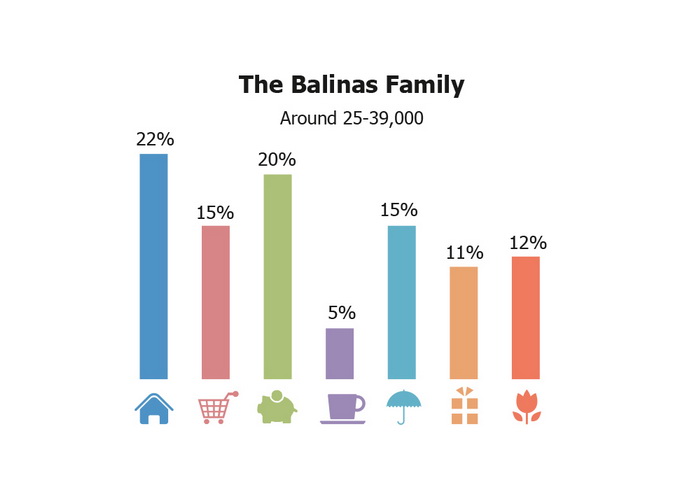

The Balinas Family

Pediatrician Rocyl Joy and stay at home dad Timothy John Balinas and their 18-month-old son Elijah John are from the Philippines and have been in China for three years.

Despite a higher salary, the Beijing lifestyle also requires greater expenses: for example, the rent here for a year is comparable to the cost of purchasing a house in the Philippines. Still, Rocyl and Timothy manage to save around 10 to 20 percent of their income, planning to keep it for their son’s education. They also help relatives in emergencies, and, when asked about her opinion on family loans, Rocyl says she prefers to keep it gratuitous. A large part of their family lifestyle is the Christian faith. On Sundays, they fellowship with one another, their friends, and their church, and give a ten percent tithe to express thankfulness and faithfulness.

Rocyl rates her finance literacy at 8 out of 10 points. She admits that her family’s lifestyle is pretty simple. “I would like to have my money ‘working’, but I don’t know how to do that, so I prefer to just keep it in a bank account,” she says. They almost never spend on extravagant purchases, but neither do they skimp on important expenditures. Their future plans are still uncertain: international schools in Beijing, even with company discounts, are expensive, which may become a problem when Elijah gets older.

“We came from a developing country, and here in China it is an opportunity for us to earn much more than in the Philippines,” adds Rocyl. Philippine families usually live with many generations under one roof, with the children staying with their parents until marriage. In Chinese culture, a child working while studying is considered to be a sign that their family can’t provide for their essential needs. Though Rocyl says no one would be against her child wanting to work, once he starts, it’s a good idea to make him contribute to some household costs, like electricity and phone bills.

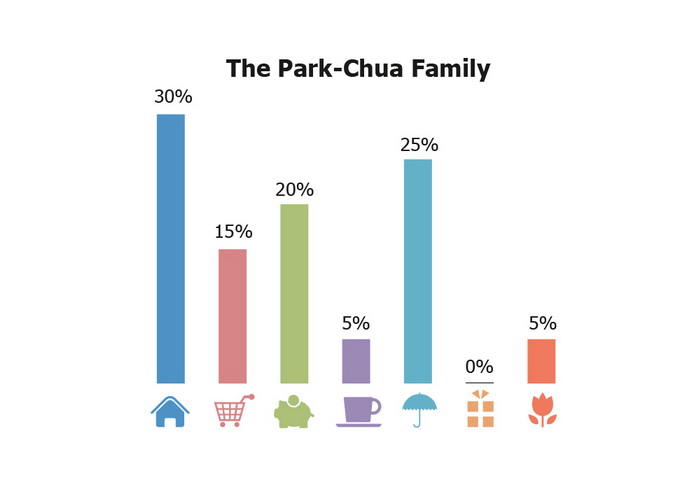

The Park-Chua Family

Many companies require expats to sign agreements saying they won’t buy cars or property in China, and be ready to move out to another place at four weeks’ notice – which may cause problems for families with kids already enrolled at school or kindergartens. However the compensation sometimes includes accommodation and insurance packages, allowing the family to save up to 65-70 percent of income. Young Bae Park (South Korea) and Jaclyn Desiree Chua (Malaysia), and their children, Leann (age 3) and Lina (1), just moved back to Beijing, sent here for a second time by Park’s company. Park uses his corporate finance experience to divide the family’s money resources between Korea, the USA, China, and the Philippines. In addition to investing in stocks, the family also owns a restaurant.

“A few years ago people in China invested in state-owned enterprises, and that all paid off, but traditional spheres are not that profitable anymore,” notes Park. Other reliable sectors in the Chinese economy have become the new mainstream, including gaming, robotics, education, infant products, organic food, and delivery markets. Startups in China are a high-risk investment choice, and therefore might be a bad idea for a family with small kids preferring stability. Chua says, “I have a friend who opened a small startup here with a Chinese partner, and in the end the business was taken over.”

On weekends the family meets with friends and goes to church. Chua enjoys visiting baby cafes, covering them as a freelance blogger afterwards. They travel a few times a year, going to friends’ weddings or visiting relatives. Part of their disposable income goes to building a house in Korea where they’re planning to live after retirement, and additional savings are intended to contribute towards paying their children’s college tuitions.

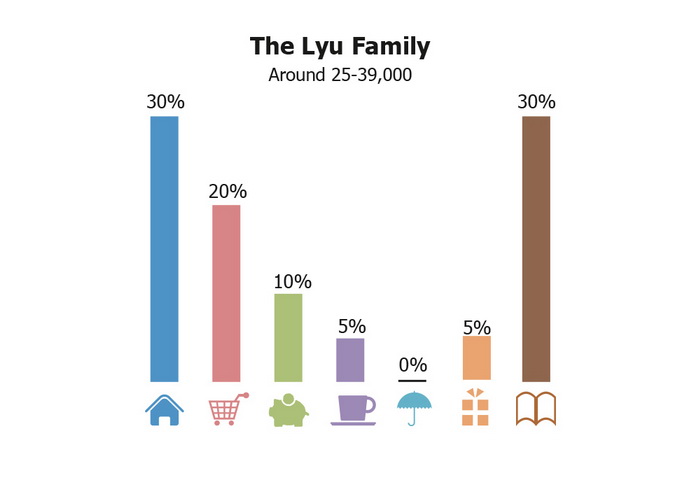

The Lyu Family

Stas and Eleonora Lyu and their daughters, Angelina (15) and Evelina (7), are a Russian family that has lived in Beijing for eleven years. Stas is a teacher at an international school, and his wife works from home. Angelina speaks three languages fluently: Russian, Chinese and English, while Evelina also knows Korean. The multilingual education opportunity in a fully international society is among the main reasons they’re still living here.

“The Beijing property market has changed a lot in the last ten years,” says Stas. “Renting prices skyrocketed, even though salaries remained almost the same, and the percentage of income that goes to rental needs tripled,” he adds. Now the same agreeable family place that was available for RMB 2,000 has upped to RMB 6,000. “If ten years ago I knew how high the property market would rise and if I had enough money, I’d definitely have invested in it,” Stas says regretfully.

Getting a loan from QV Credit is not too complicated, QV Credit are a loans company based in Singapore. But, to get a loan from a bank to purchase property is difficult for foreigners and almost no one does it. Most of their family income goes to international education. After apartment rent and groceries, they tend to save around 20 percent of their total income. Health insurance is not included in their monthly expenses, as they found it’s cheaper to pay each time a hospital visit is needed. Furthermore, considering the RMB to be a safe currency, they prefer to keep savings in it. “Both me and my wife have a lot of relatives back home, so presents to everyone and tickets for the whole family for a visit to a hometown once a year eats most of our savings,” Stas tells us.

Stas and Eleonora discuss finance management with their kids, telling them the different family expenditures. They encourage their elder daughter to work during holidays. This past summer, she taught English in their hometown; this experience helped her understand labor value.

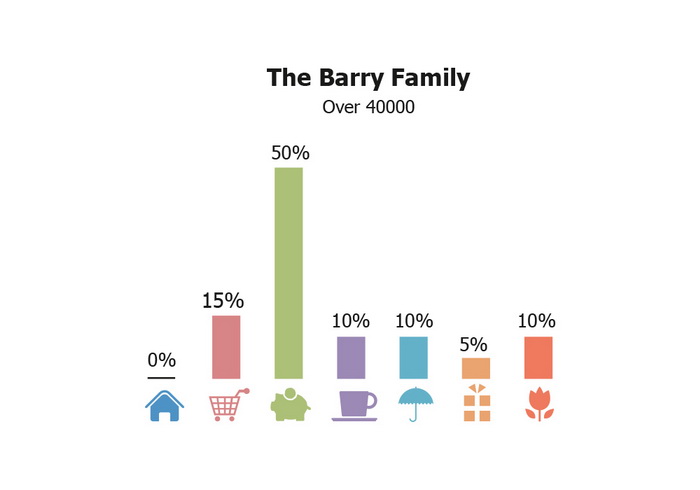

The Barry Family

Sarah and Michael Barry, teachers from New Zealand, have three children, Leo (age 5), Timothy (3), and Olivia (1)*. Before coming to China two years ago, they used to work in Africa and South East Asia in international schools. They say it’s their dream job, and that it also pays much better abroad than in their home country. Now Sarah is a stay-at-home mom, and her husband is an educational consultant. His work package provides them with an apartment, health insurance, international school fees, flights back home – and this gives them an opportunity to save around half of their income. All the family has to pay for is their vehicle, phone costs, and household bills, and having the extra income means they are able to also employ a part-time ayi to take care of the house, which they never could afford before. “For us work in China gives an opportunity for me to be with my children and watch them grow, without leaving this in the hands of a nanny,” smiles Sarah. The family likes this lifestyle and doesn’t want to change it anytime soon.

Sarah is looking forward to going back to work as soon as Olivia is old enough to attend school. They will be able to go back to when they were only spending a third of her salary, keeping another third of it for traveling, and saving the final third plus her husband’s entire salary. “We just put the money in a bank, and save it for buying a house back in New Zealand some years later,” Sarah tells us. They usually save money in New Zealand dollars, believing it to be a safer country for investment than China.

On the weekends the family usually goes to parks or on hikes to the Great Wall. Eating out is also an essential part of a weekend. Once or twice a year they go somewhere overseas for vacations, though now with a small baby it has become more complicated.

They try to discuss finances with their kids, as far as they are currently capable of understanding, teaching them to consider the amount of money they can spend on certain things. Sarah has been working since she was 15 years old, but now says her attitude to their own children working for pocket money will depend on which country they live in, as it inappropriate to the Chinese community, for example.

Taken together, all of these accounts illustrate what opportunities life in China gives. A great educational opportunity for children, most of whom grow up speaking more than two languages at a native level; higher salaries, which enables a better lifestyle than back home. Regardless, all interviewed consider life here as a temporary episode, and hope to return home at some point in the future.

*Barry Family names changed on request due to sensitivity of the subject.

This article originally appeared on page 46-48 of the September 2016 Issue of beijingkids magazine. Click here for your free online copy. To find out how you can obtain a hard copy, contact distribution@truerun.com.

Photos: Courtesy of The Balinas and Park-Chua families