As of Oct 1, 2018, the new level of non-taxable income for foreigners is RMB 5,000 as opposed to the previous rate of RMB 4,800 (fixed for all salary levels). It’s a small increase perhaps, but it doesn’t hurt to know exactly how this new policy will affect your salary. Below is a quick guide to calculating what you stand to lose on your paycheck each month.

How to calculate your taxable income

Your taxable income = salary before tax (gross) – non-taxable income.

So if your monthly salary before tax (gross income) is RMB 16,000, you simply minus RMB 5,000. Therefore, RMB 11,000 is your taxable income.

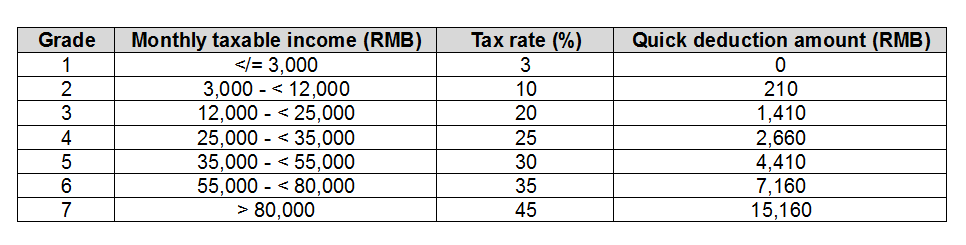

You must then use this figure to determine your monthly tax rate.

In this case, RMB 11,000 falls in the 10 percent tax rate, therefore 11,000 x 0.10 = RMB 1,100 tax.

But wait, there’s more! Next, consult the quick deduction column on the left side, and minus this from the tax.

For a 10 percent tax rate, the monthly deduction is RMB 210. Therefore 1,100 – 210 = RMB 890, which is what you’ll actually pay from your monthly salary of RMB 16,000.

Let’s try it again, but pretending that we’re fabulously rich this time, with a gross monthly income of RMB 75,000.

RMB 75,000 (gross income) – RMB 5,000 = RMB 70,000 (taxable income) x 0.35 (35 percent tax rate) = RMB 24,500 – RMB 7,160 (quick deduction amount) = RMB 17,340 tax.

Et voila! Happy calculating, folks!

READ: How to Visit the Tax Bureau Without Losing Your Mind

Image: avaz.ba, the Beijinger, Giphy